The Future of Autonomous Vehicle Insurance: Redefining Risk Assessment Models

Insuring autonomous vehicles poses a unique set of challenges for insurance companies. One major issue is determining liability in the event of accidents involving these self-driving vehicles. Unlike traditional car accidents where human error is often to blame, accidents involving autonomous vehicles could raise questions about the responsibility of the vehicle manufacturer, software developers, or even third-party service providers.

Another challenge is the lack of historical data on autonomous vehicle accidents, making it difficult for insurance companies to accurately assess risk and set premiums. With limited data available, insurers may struggle to predict the frequency and severity of claims associated with self-driving cars, leading to uncertainty in pricing policies for autonomous vehicle owners. This lack of actuarial data and established risk models presents a hurdle for the insurance industry as it adapts to the rise of autonomous vehicles on the roads.

Impact of Advanced Technology on Insurance Industry

Advanced technology has significantly reshaped the landscape of the insurance industry. With the advent of autonomous vehicles and telematics systems, insurance companies are adapting to the new risks and opportunities presented by these innovations. The integration of artificial intelligence and data analytics has enabled insurers to better assess risk profiles, personalize policies, and streamline claim processes for a more efficient and customer-centric experience.

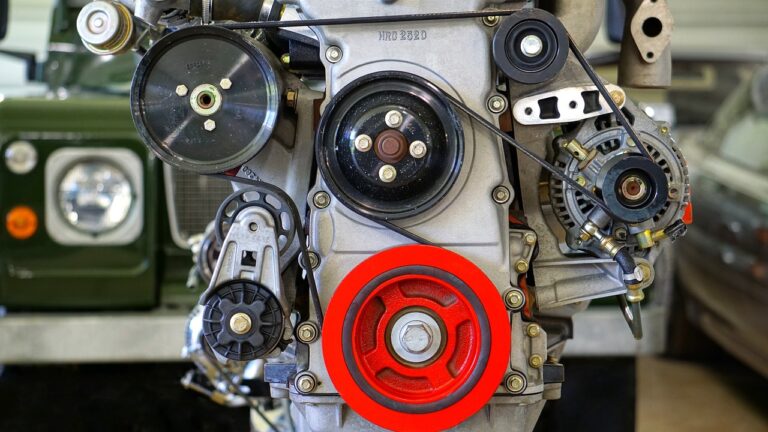

Moreover, the use of sensors and IoT devices in vehicles allows for real-time monitoring of driver behavior and vehicle performance, leading to a more proactive approach to risk management. This data-driven approach not only helps in preventing accidents but also provides insurers with valuable insights to accurately price policies based on individual driving habits and patterns. As technology continues to evolve, the insurance industry must embrace these advancements to stay relevant and competitive in a rapidly changing market.

Behavioral Changes in Drivers and their Influence on Insurance

With the introduction of innovative technologies in vehicles, the landscape of driver behavior is gradually shifting. Advanced features like lane departure warning systems, automatic emergency braking, and adaptive cruise control are urging drivers to rely more on these automated functions rather than on their own driving skills. This trend poses a challenge for insurance companies, as the risk associated with human error diminishes with the increased integration of technology in vehicles.

Moreover, the rise of ride-sharing services and the popularity of carpooling are leading to changes in individual driving habits. With more people choosing to share rides or utilize alternative modes of transportation, the frequency and patterns of personal vehicle usage are evolving. This shift in behavior has repercussions for insurance providers, who must adapt their policies to address the varying needs and risk profiles of drivers engaging in shared transport practices.

• As technology in vehicles advances, drivers are relying more on automated functions

• Lane departure warning systems, automatic emergency braking, and adaptive cruise control are becoming more common

• Insurance companies face challenges as the risk associated with human error diminishes

• Ride-sharing services and carpooling are changing individual driving habits

• Frequency and patterns of personal vehicle usage are evolving

• Insurance providers must adapt policies to address the varying needs of drivers engaging in shared transport practices.

How do behavioral changes in drivers impact insurance rates?

Behavioral changes in drivers, such as distracted driving or aggressive driving, can lead to an increased risk of accidents. Insurers may adjust insurance rates based on these behaviors to reflect the higher likelihood of a claim.

What role does advanced technology play in determining insurance premiums?

Advanced technology, such as telematics devices or cameras in vehicles, can provide valuable data on driver behavior. Insurers may use this data to offer discounts to safe drivers or to adjust rates for high-risk behaviors.

Will the rise of autonomous vehicles pose challenges for the insurance industry?

Yes, insuring autonomous vehicles presents unique challenges, such as determining liability in the event of an accident. Insurers will need to adapt their policies and pricing models to account for the changing landscape of transportation.

How can drivers contribute to lower insurance premiums through their behavior?

Drivers can help lower their insurance premiums by practicing safe driving habits, such as obeying speed limits, avoiding distractions, and following traffic laws. Insurers may offer discounts to drivers who demonstrate responsible behavior on the road.